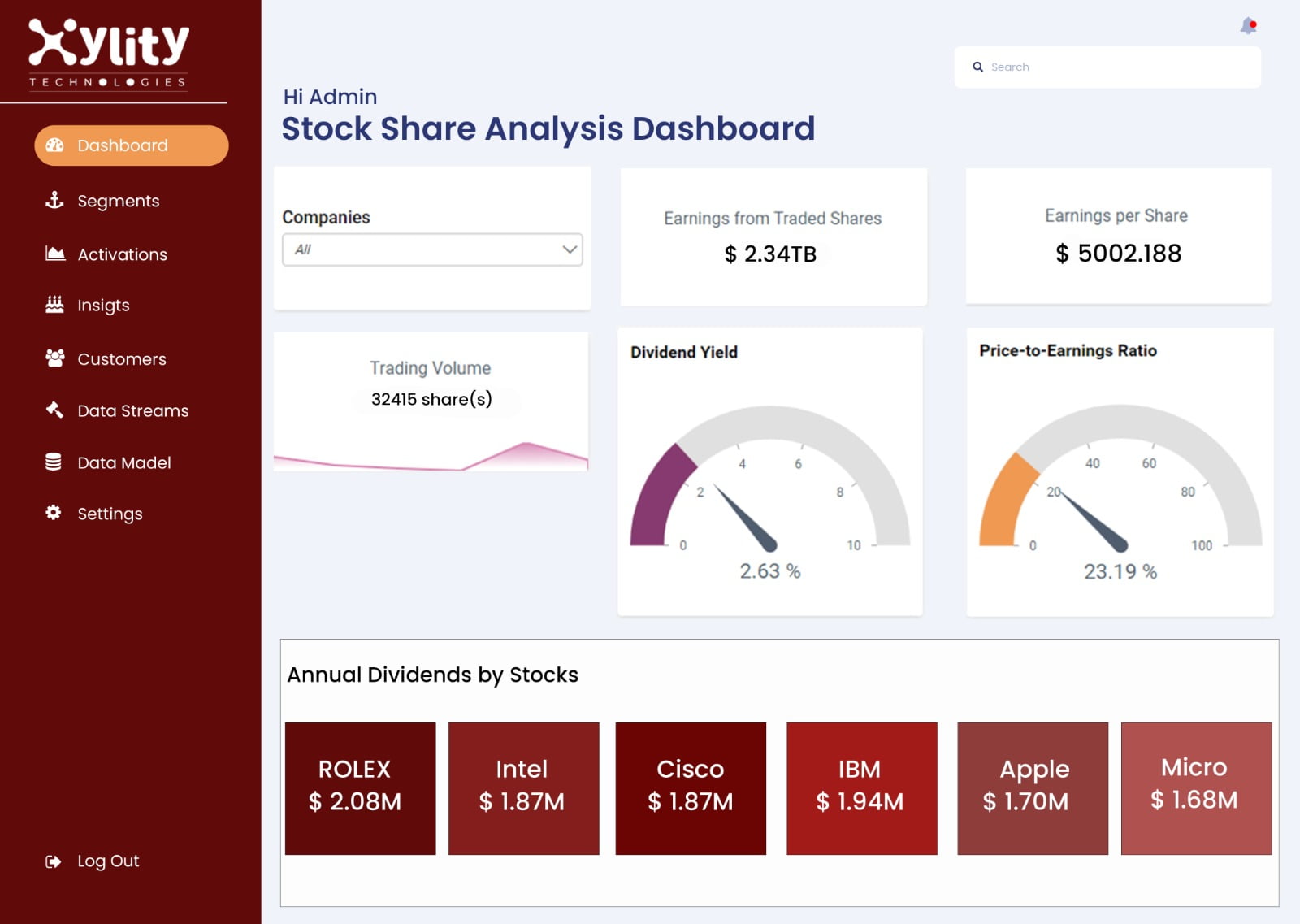

| Executive Financial Dashboard | Real-Time Insights, Visually Appealing, Drill-Down Capabilities, Unified Data Source | Total Revenue, Net Profit, Cash Flow, Gross Margin, Risk Indicators, Executive Summary |

| Sales Performance Dashboard | Data-Driven Decision Making, Track Revenue by Product/Region/Sales Rep, Sales Goals, Pipeline Overview | Sales Revenue, Sales Goals, Pipeline Overview, Customer Acquisition, Sales Cycle Length, Sales Rep Performance |

| Expense Management Dashboard | Clear View of Spending, Track Total Expenses, Budget vs. Actual, Uncover Spending Patterns | Total Expenses, Budget vs. Actual, Spending Patterns, Top Expense Categories, Vendor Analysis, Employee Expenses |

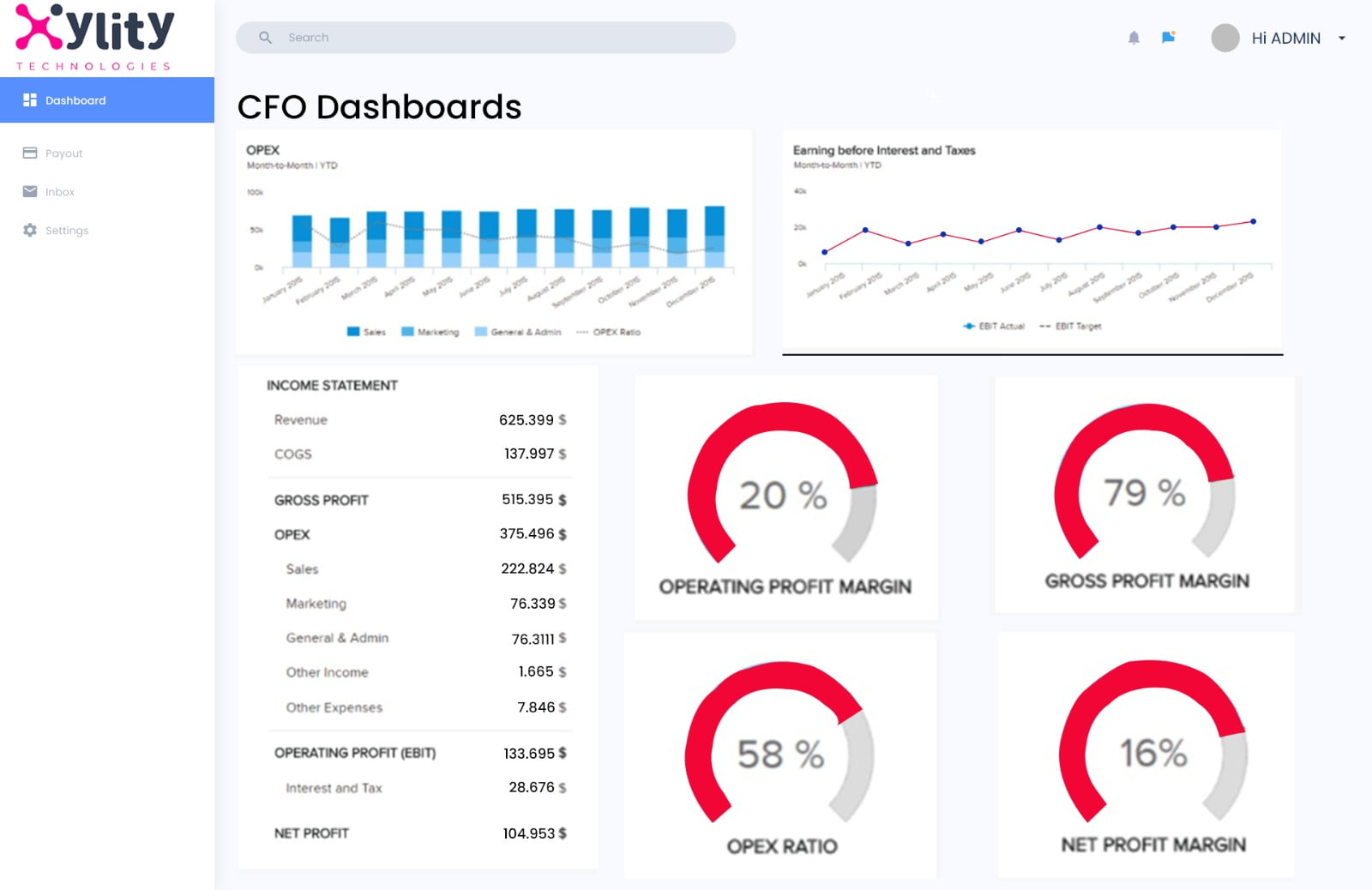

| Profitability Analysis Dashboard | Analyze Gross/Operating Profit Margins, Customer/Product Profitability, Cost Analysis, Scenario Analysis | Gross Profit Margin, Operating Profit Margin, Customer Profitability, Product Profitability, Cost Analysis, Scenario Analysis |

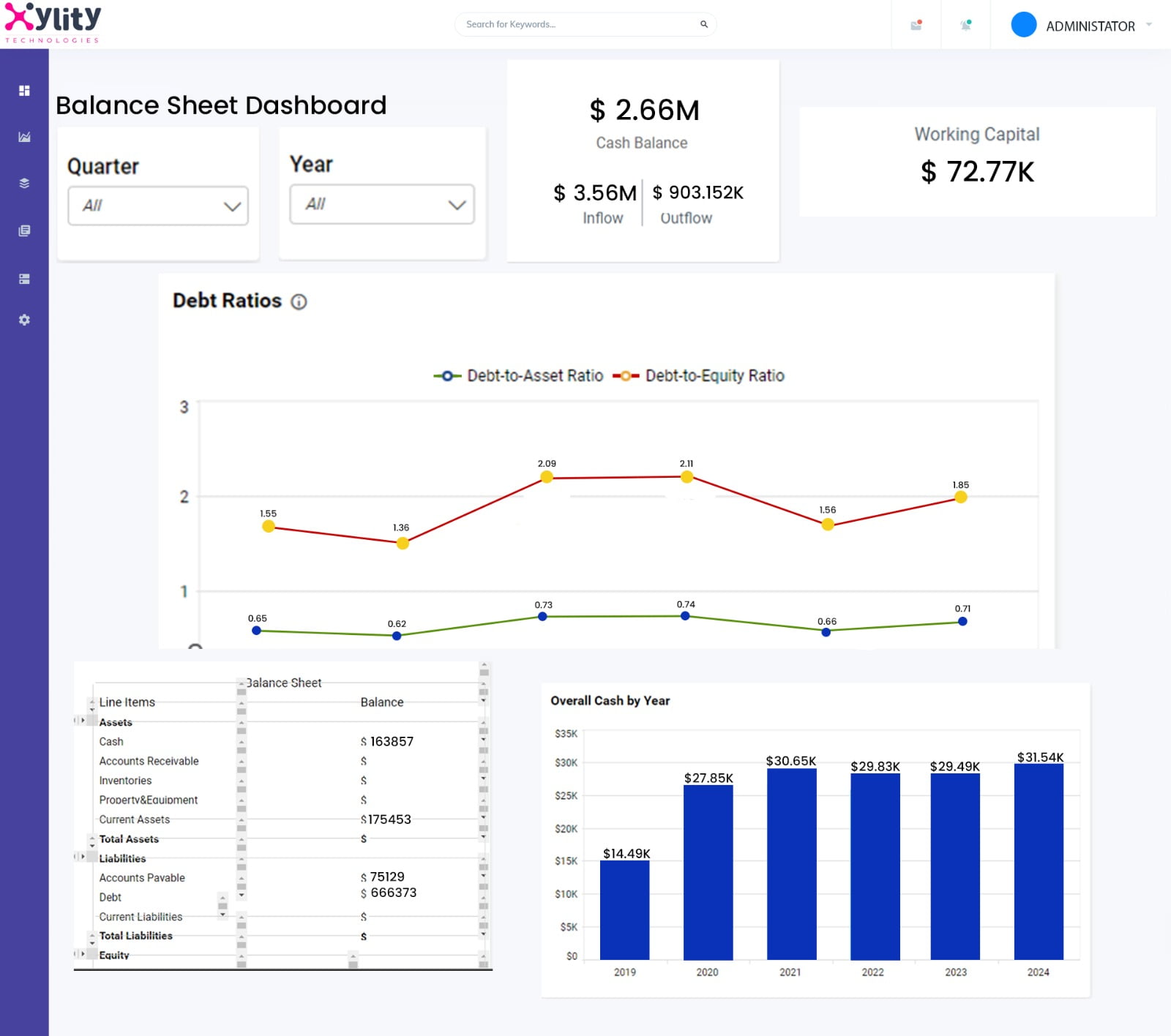

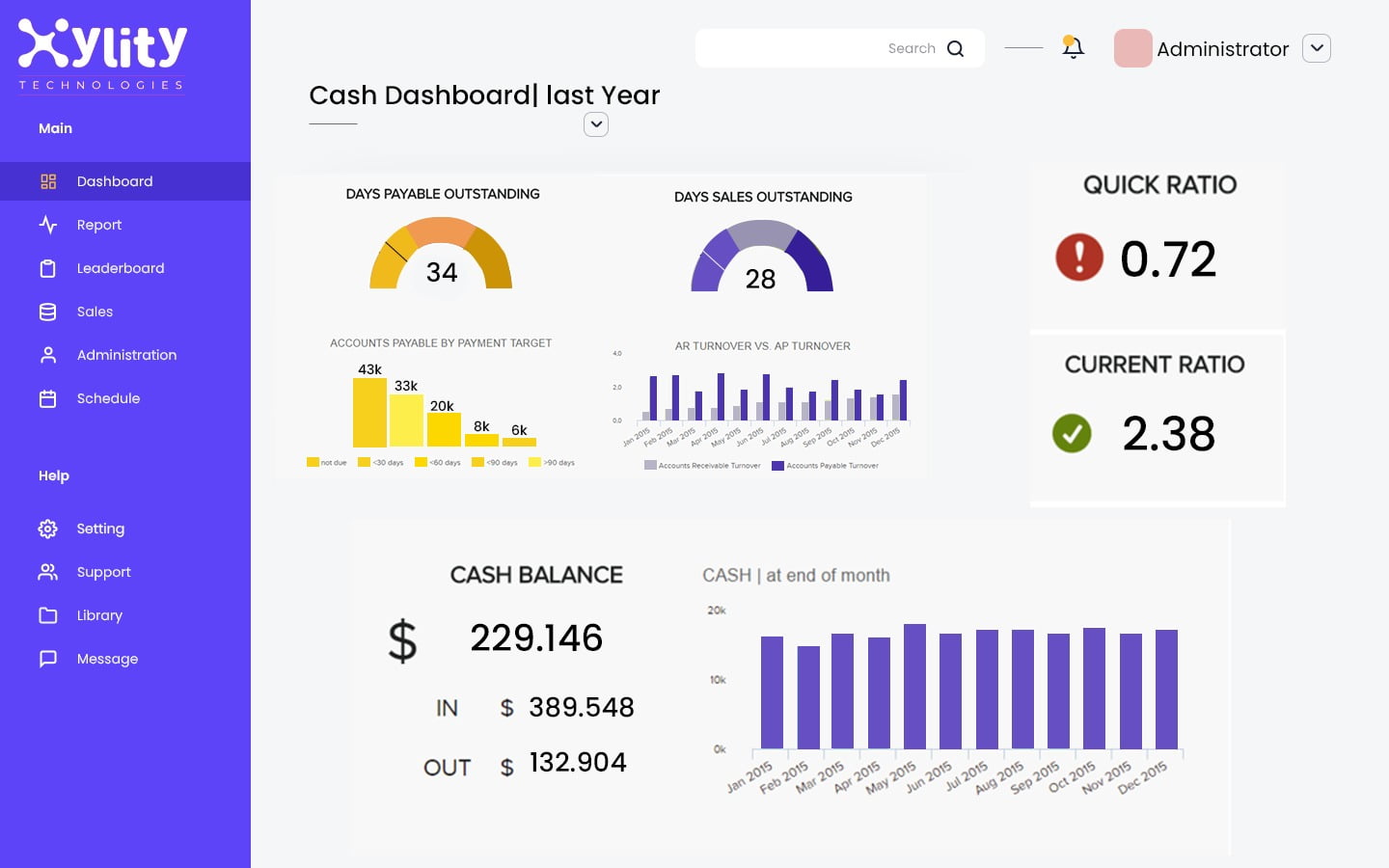

| Cash Flow Management Dashboard | Real-Time Cash Flow Insights, Cash Flow Forecast, Cash Burn Rate, Days Sales Outstanding, Working Capital | Cash Flow Forecast, Cash Burn Rate, Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Working Capital, Cash Conversion Cycle |

| Financial Statement Dashboard | Fast & Accurate Financial Reports, Income Statement, Balance Sheet, Cash Flow Statement, Financial Ratios | Income Statement, Balance Sheet, Cash Flow Statement, Financial Ratios, Variance Analysis, Forecasting |

| Financial Prediction Dashboard | Advanced Analytics, Revenue/Expense Forecasting, Cash Flow Projections, Scenario Analysis, Risk Assessment | Revenue Forecasting, Expense Forecasting, Cash Flow Projections, Scenario Analysis, Risk Assessment, Predictive Modeling |

| Accounts Receivable/Payable Dashboard | Up-to-Date Accounts Information, Receivable/Payable Aging, DSO/DPO, Customer/Vendor Analysis, Forecasting | Accounts Receivable Aging, Accounts Payable Aging, Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Customer/Vendor Analysis, Forecasting |