Enhancing Financial and Insurance Performance Through Data Analytics and Power BI

Managing Risk and Reward with a Data-Driven Culture

The most successful insurance organizations balance short-term risks with long-term rewards. Their success relies on offering the right products, having the right people to sell them, and effectively managing the risks associated with insurance policies. Using key insurance KPIs and metrics can help strike this balance.

Challenges in the Insurance Sector

Insurance companies face unique challenges that hinder operational efficiency and informed decision-making:

- Lack of streamlined workflows for creating dashboards and reports

- Multiple hierarchies on on-premises platforms impeding drill-down capabilities

- Limited ability to analyze data comprehensively for decision-making

- Irregular reporting practices causing delays and inaccuracies

- Absence of a central repository for a ‘single version of the truth’

- Prolonged time from data to insight, leading to missed opportunities

- Inability to ingest and integrate semi-structured and unstructured data

- Significant IT bandwidth spent on data store management and maintenance

- Lack of enriched data for data science with no supporting infrastructure

Key Use Cases for BI in Insurance

| Identifying Fraud | Risk Management | Policy Pricing |

| Legacy Technologies | Claims Management | Regulatory Changes |

Importance of KPIs in Finance and Insurance

Organizations in the finance and insurance sectors, including brokers and agencies, use KPIs to measure success, ensure growth, and foster operational efficiency.

KPIs enable tracking of:

Operational Efficiency

Risk Management

Customer Satisfaction

Risks of Not Monitoring KPIs

Neglecting KPIs exposes companies to:

Lack of accountability

Poor decision-making

Missed growth opportunities

Loss of investor confidence

Competitive disadvantages

More specifically, insurers require the following:

A data pipeline capable of capturing and storing diverse data sources, including social media and text logs.

In-memory processing to quickly prepare data for reporting and deliver real-time insights.

Tiered storage for efficient access during audits or reviews.

Compatibility with BI processes for seamless access by business users.

Advanced analytics for claims insights, connected opportunities, and optimized pricing/risk management.

Power BI for Insurance Companies

Xylity leverages Power BI to deliver tailored solutions for the insurance industry. Here’s why Power BI is ideal for insurance companies:

Key Benefits

Enterprise-Grade Security

Rigorous data encryption, role-based access controls, and adherence to compliance standards (e.g., GDPR, ISO 27001).

Seamless Integration

Connects with Azure, Office 365, and Dynamics 365, leveraging existing Microsoft infrastructures.

Enhanced Data Visualization

Interactive dashboards simplify complex data insights.

Real-Time Analytics

Timely information for proactive decision-making.

Customizable Reports

Tailored to specific business objectives.

Dashboard Showcase

Real Client Dashboards

Below are examples of dashboards created for our insurance clients:

Executive Dashboard

Making profitable decisions requires data-driven insights. Our specialized insurance dashboards provide real-time analytics so you can optimize your book of business.

With our dashboards, you can:

- Track Revenue Trends: Follow annual premiums collected to forecast growth.

- Monitor Claims Performance: View total payouts and breakdowns by product line. Control spending.

- Analyze Producers: See claims payouts and revenue generated per producer using bar charts. Identify high performers.

- Assess Products: Use bar charts to compare revenue across product lines. Double down on profitable products.

- Select Timeframes: Filter data by year to identify trends over time. Spot issues early.

- Make Strategic Decisions: Backed by data, adjust product mixes, incentivize star producers, and more.

With comprehensive insights into your book of business, you can manage risk, growth, and profitability more effectively. Our insurance dashboards provide clarity when you need it most.

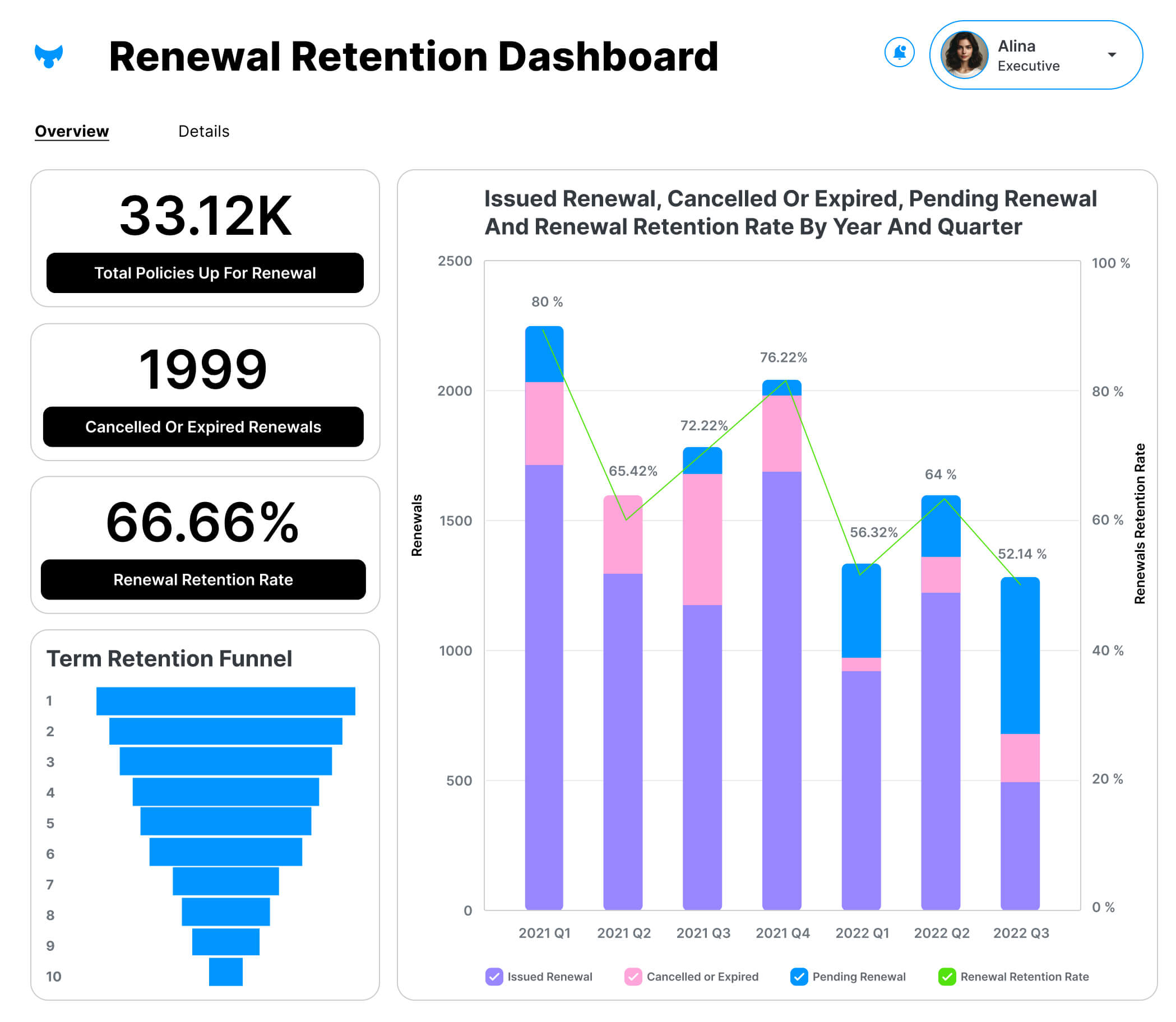

Renewal Retention Dashboard

Keeping customers renewing is crucial for steady revenue. Our intuitive renewal dashboards provide real-time analytics so you can improve retention strategies.

With our dashboards, you can:

- Track Retention Rates: View renewal retention percentages over time with bar graphs segmented by year and quarter. Identify issues quickly.

- Pinpoint Dropout Stages: See where customers are lost in the renewal process using our retention funnel. Focus efforts on leakiest stages.

- Monitor Summary Stats: Keep tabs on total renewals, cancellations/expirations, and overall retention rate. Set performance goals.

- Identify Trends: Spot renewal patterns by factors like customer segment, geography, sales rep, and more. Customize analyses as needed.

- Make Data-Driven Decisions: Backed by analytics, adjust renewal touchpoints, incentives, and customer care to maximize retention.

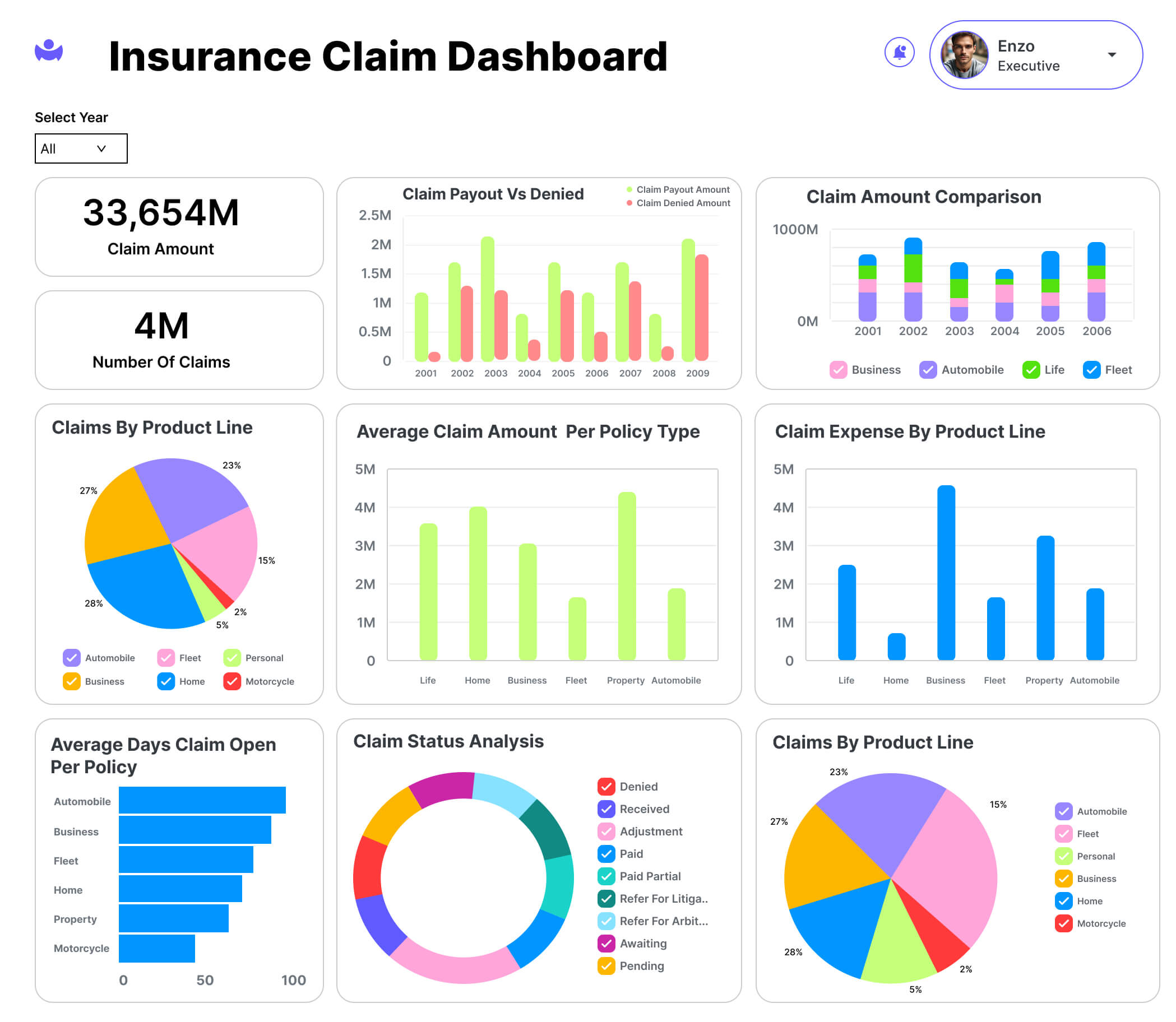

Claims Dashboard

Managing claims effectively is crucial for insurance providers. Our intuitive claims dashboards provide real-time analytics so you can make data-driven decisions.

With our dashboards, you can:

- Track Claim Amounts: Monitor total payouts and compare across years. Control spending.

- Analyze by Product Line: View claim distribution across product lines using pie charts. Assess profitability.

- Compare Policies: Follow metrics like average claim amount and days open by policy type via bar graphs. Identify issues.

- Assess Expenses: Use line graphs to see claims spending trends over time. Forecast costs accurately.

- Check Claim Status: Bar charts provide status overviews and help speed processing and closure.

- Monitor Assured Amounts: Bar graphs show assured amount analysis by policy type. Ensure sufficient reserves.

With comprehensive insights into your claims handling, you can enhance processes and reduce expenses. Our dashboards transform messy data into clear visualizations.

Types of Power BI Reports for Insurance Companies

Claims Management

Claims Overview Report

Comprehensive view of claims

Claims Processing Time

Highlights delays for efficiency improvements

Fraud Detection Report

Detects anomalies signaling fraudulent claims

Customer Insights

Demographics Report

Visualizes customer distribution

Satisfaction Report

Analyzes feedback for better retention

Customer Retention Report

Monitors churn and suggests retention strategies

Financial Performance

Premium Income Report

Revenue trends over time

Expense Management Report

Operational cost insights

Profit and Loss Report

Detailed profitability analysis

Risk Management

Risk Assessment Report

Supports strategic risk mitigation

Risk Exposure Report

Evaluates geographical and product-specific risk levels

Operational Efficiency

Resource Allocation Report

Optimizes staffing and resources

Operational Metrics Report

Monitors claim processing times and workflow efficiency

Predictive Analytics

Predictive Risk Models Report

Uses historical data to forecast risks

Future Claims Forecasting Report

Projects future claims for planning and budgeting

Advanced Analytics for Insurance Companies

Function-Specific Use Cases

- Marketing:

Campaign Tracking

Monitor performance and ROI of marketing campaigns.

Prospect Analytics

Gain insights into potential customers’ behavior and preferences.

Customer Segmentation

Identify and target specific customer groups for personalized marketing efforts.

Customer Retention

Analyze churn factors and create retention strategies.

- Sales:

Channel Pricing

Optimize pricing strategies for various sales channels.

Agent Productivity Tracking

Evaluate performance metrics for sales agents.

Reward Systems

Design and monitor compensation models for agents.

- Claims:

Fraud Detection

Use advanced analytics to identify suspicious patterns.

Propensity Modeling

Predict the likelihood of claims to allocate resources efficiently.

Adjuster Alerts

Automate notifications for claims requiring immediate attention.

- Operations:

Contact Center Analytics

Monitor call volumes, customer interactions, and service quality.

Staffing Optimization

Align staffing levels with predicted workloads for efficiency.

Interactive Voice Response (IVR)

Analyze IVR system performance to improve customer experience.

- Actuarial:

Expense Management

Track and control operational and reserve costs.

Reserve Analysis

Use predictive analytics for accurate IBNR (Incurred But Not Reported) estimations.

Mathematical Models

Leverage actuarial tools to calculate risk and pricing effectively.

Subrogation Effectiveness

Evaluate recoveries from third parties to enhance financial performance.

Xylity’s Data and Analytics Services for Insurance

Our offerings include:

Approach

Strategy and Planning

Data strategy, AI strategy, data governance.

Implementation

Data platform builds, migration, and visualization.

Adoption and Maintenance

Training, support, and program maintenance.

Frameworks

Data Validation Framework

Ensures high-quality, accurate data.

Cloud Migration Framework

Simplifies transition to cloud-based systems.

Self-Service BI Framework

Empowers users with accessible analytics tools.

Start Your Data-Driven Journey

Embrace data analytics to transform your operations, identify trends, and make informed decisions. Xylity Technologies empowers your insurance business to:

Measure what matters

Act on insights

Drive sustainable growth

About Xylity Technologies

Xylity Tech is a global leader in partnering with companies to harness technology’s power. Our deep industry expertise and strong technological background make us a trusted partner for strategy, operations, and innovation.

Contact us today to unlock the power of your data.

Get in Touch

USA

24610 Durindal Ter,

Sterling, VA 20166, USA.

India

3rd Floor, 340 F-AD

Scheme 74-C, Vijay Nagar, Indore – 452010, M.P

Poland

Bronowicka 17A,

Krakow 30-084

Germany

Bleicheroder Straße 13, 13187,

Berlin, Germany