A top 10 provider of property and casualty insurance

Based in Charlotte, NC (USA)

Our client has proudly served customers for over 75 years, earning a reputation as a trusted and stable provider of property and casualty policies. Headquartered in Charlotte, NC, our client employs over 2,000 insurance professionals across 21states.

They write in excess of $8 billion in annual premiums across personal and commercial lines of insurance including auto, home, and business insurance.

Our client strives to make insurance simple and stress-free for their customers through personalized service, flexible coverage options, and fast claims response times. In recent years, the company has placed greater emphasis on data-driven decision making and customer insights to differentiate in an increasingly competitive industry.

The client sought to modernize their aging on-premise analytics platforms to better support strategic business goals. They found the existing data warehouse infrastructure created barriers to accessing customer and product insights at scale.

Silos of data also inhibited customized analytics across lines of business.

Their vision was to consolidate their data assets, standardize data management, and enable self-service analytics leveraging advanced technologies. This would allow data-driven decisions to be scaled throughout the organization.

Executives hoped the new environment could fuel innovative uses of Al/ML to improve customer experience, identify new revenue opportunities, and enhance underwriting performance.

The overriding aim was empowering agility to stay ahead of shifting market trends and customer demands in the coming years.

The client faced significant hurdles with their legacy systems:

These barriers prevented our client from maximizing the value of their customer insights assets. A modern cloud solution was required to eliminate silos and enable analytics at the speed of business.

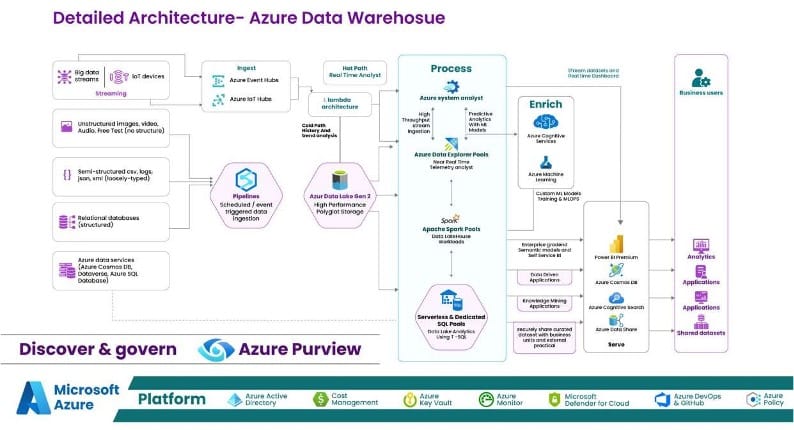

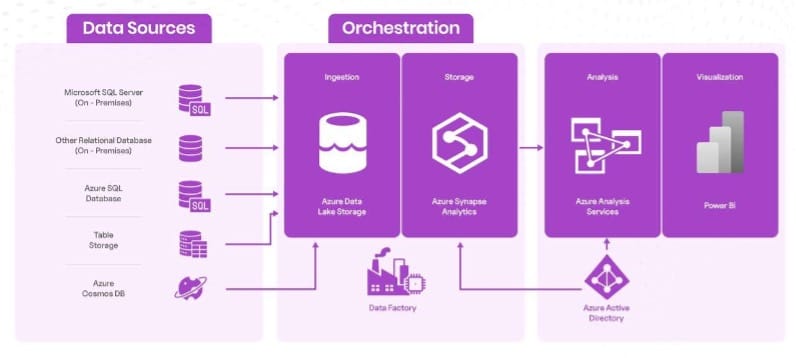

We at Xylity designed a modern cloud data and analytics platform on Azure to overcome our clients challenges:

Azure synapse Analytics – This served as the scalable analytics engine, using:

Azure Data Lake Storage – A scalable data lake ingested 50TB of raw historical data via:

Azure Active Directory – Provided single sign-on, access controls and governance alignment.

Azure Machine Learning – Notebooks provisioned on Spark helped data scientists:

This architecture removed on-prem barriers to deliver analytics-at-scale through a fully managed cloud service.

Our client partnered with us to leverage their Azure expertise and migrate the analytics platforms:

Our client realized substantial business benefits post-migration:

Our client now has an enterprise-grade, cloud-based analytics hub delivering competitive advantage. As our expert consultants migrate other lines of business, insights will further transform actuarial science, pricing, fraud detection and underwriting.

Insurance has always relied upon quality data assets-

Xylity Consulting can help your organization leverage them through modern architectures on Azure. Whether migrating from legacy platforms or architecting greenfield analytics from inception, we have the expertise to eliminate your obstacles and create opportunities through insightful data.

Contact us to discuss how we powered our insurance giant client insights revolution and how we can do the same for you.