Transform. Innovate. Accelerate.

Close

Navigate uncertainty. Manage risk proactively. Deliver hyper-personalization. Discover transformative insights to guide your insurance business.

Xylity harnesses leading-edge BI and analytics to convert raw data into your North Star metrics. As trusted navigators, we architect flexible pipelines to integrate, govern, and refine data for cloud-scale analytics.

Sophisticated AI and ML models sharpen actuarial precision while real-time visualization illuminates the way forward. By unifying a 360-degree customer view, pinpoint risks before claims are filed.

Let our cloud analytics chart your course to become an insights-driven disruptor ready to brave future data currents and captain new opportunities.

Transform. Innovate. Accelerate.

Is your insurance company struggling to stay afloat amidst a flood of structured and unstructured data? Legacy on-premise systems can’t keep pace with astronomical data scale. As volume, variety, and velocity swell, these rigid platforms strain and crack under mounting pressure.

Xylity provides the life raft to migrate your core data assets to the virtually limitless capacity of the cloud. By moving key data platforms to Microsoft Azure, insurers can safely ride accelerating data currents.

With Xylity, insurers can harness data like never before, detecting risks proactively, delivering hyper-personalized customer experiences, and driving operational excellence.

Let us provide your life raft to weather the data deluge. With Xylity, Azure’s limitless scale makes the data tsunami feel like smooth sailing.

If your insurance data warehouse groans under mounting data volume, it may be time to break camp from on-premise limitations. Rigid legacy infrastructure can’t keep pace with your expanding analytics needs.

Xylity is your expert guide for this journey to the cloud. We’ll start by fully profiling your current analytics environment:

Equipped with this plan, we’ll help you leave outdated systems behind so you can reach new heights.

Typical on-premise environments we upgrade include:

With Xylity as your guide, you’ll break free of on-premise constraints on your analytics capabilities. We’ll establish a flexible cloud base camp tuned for scale and real-time insights.

break camp. onward upward. conquer the climb

Migrating core data platforms to the cloud involves meticulous planning and flawless execution. As your expert navigator, Xylity’s seasoned team undertakes a rigorous process to architect your ideal cloud environment.

The journey starts by fully profiling your existing data landscape. We identify opportunities and chart the optimal path forward:

With the guiding principles established, we undertake the migration:

Along the way, we configure robust security, access controls, and data governance.

With Xylity as your copilot, you can trust your precious data assets are in safe hands. Our meticulous approach ensures a smooth flight to the cloud.

Careful preparation is the key to any successful cloud migration. Let Xylity provide the meticulous planning and flawless execution needed to securely transition your data to the cloud. With our seasoned experts at the helm, you can relax knowing even the most complex migration will be smooth sailing. Your data’s safe passage is our top priority.

Like an oyster transforming grit into a pearl, Xylity specializes in crystallizing order from the chaos of raw, messy data.

Through rigorous data preparation, we shape scattered data fragments into structured information assets. Our process includes:

With meticulous cleansing and refinement, we primp messy data until it’s presentation-ready for analysis. The outcomes are transcendent:

Leave no data behind. Extract value from every bit with Xylity’s expert refinement techniques. We shape scattered fragments into precious data pearls poised to illuminate game-changing insights.

Robust security is the foundation for impactful analytics. Xylity employs defense-in-depth strategies to fully safeguard your data from unauthorized access and abuse:

User Access Control – Azure Active Directory for secure sign-on

With meticulous controls across users, network, apps, and storage, your data assets are fully shielded from compromise. You can unlock deeper insights through analytics, knowing security is locked up tight.

Let Xylity establish robust protections so you can focus on actionable analytics. With defense-in-depth security built into every layer of your cloud data environment, you can drive your business forward knowing your analytics foundation is impenetrable.

With rock-solid analytics foundations established, the real excitement begins – deriving groundbreaking insights that disrupt insurance norms.

Xylity helps insurers tap into previously unimaginable use cases:

ML algorithms crunch usage-based data to dynamically customize policies and rates to each customer’s behaviors and evolving risk profiles.

AI sniffs out fraudulent claims in real-time by detecting subtle patterns across networks. Fight fraud before payments go out the door.

Overlay geographic, demographic, and risk data to finely calibrate underwriting and pricing at local levels.

Create holistic customer profiles by unifying data across CRM, web, social media, and IoT sources. Serve hyper-targeted experiences

The possibilities are endless. With Xylity, insurers evolve from reactive claims processors to proactive risk managers delivering precision over blanket-spray policies. Let us help you transform into a customer-centric disruptor led by data-driven decisions at every turn.

Derive strategic value from your insurance data with 3 of our super interactive dashboards.

Making profitable decisions requires data-driven insights. Our specialized insurance dashboards provide real-time analytics so you can optimize your book of business.

With our dashboards, you can:

With comprehensive insights into your book of business, you can manage risk, growth, and profitability more effectively. Our insurance dashboards provide clarity when you need it most.

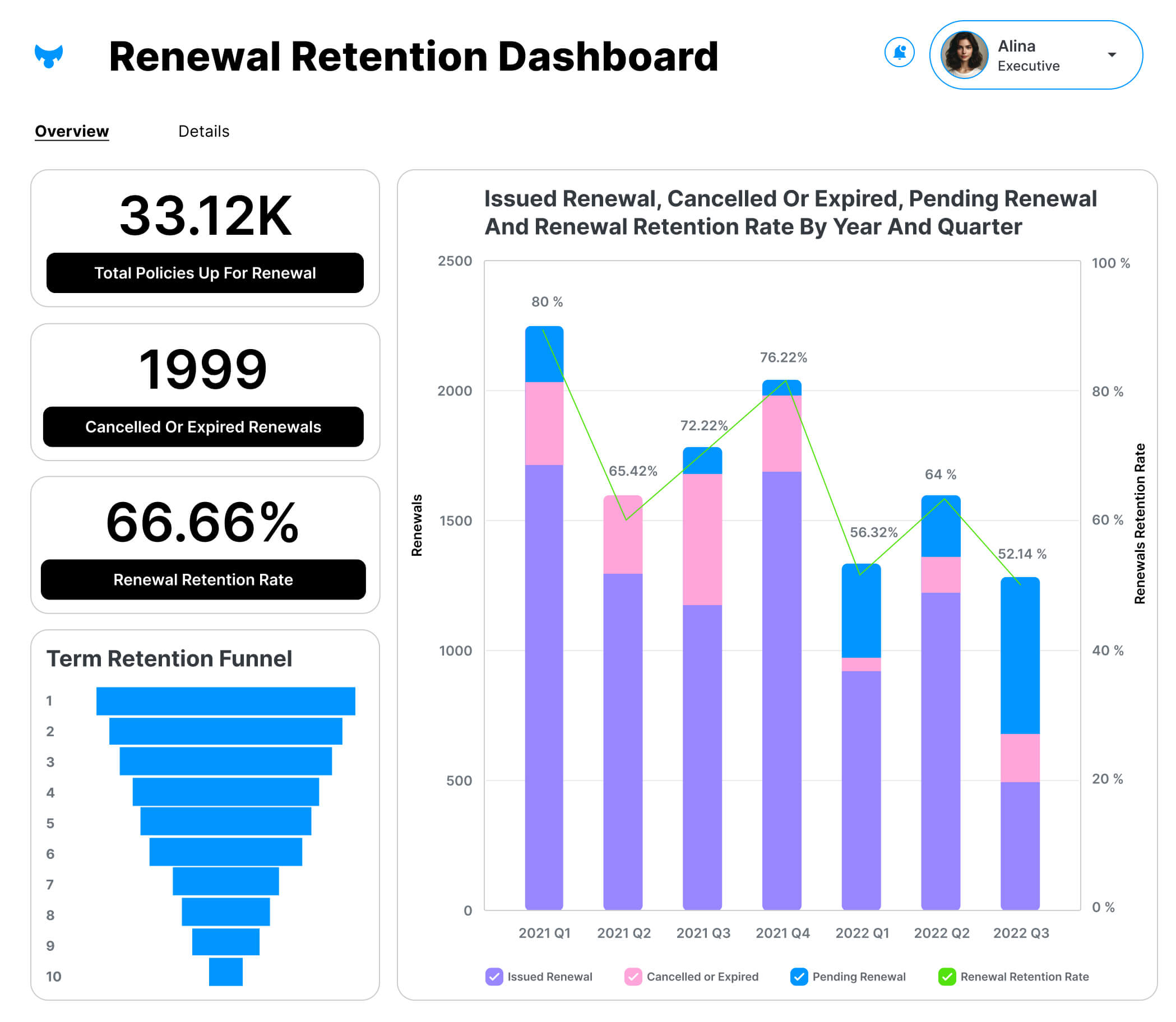

Keeping customers renewing is crucial for steady revenue. Our intuitive renewal dashboards provide real-time analytics so you can improve retention strategies.

With our dashboards, you can:

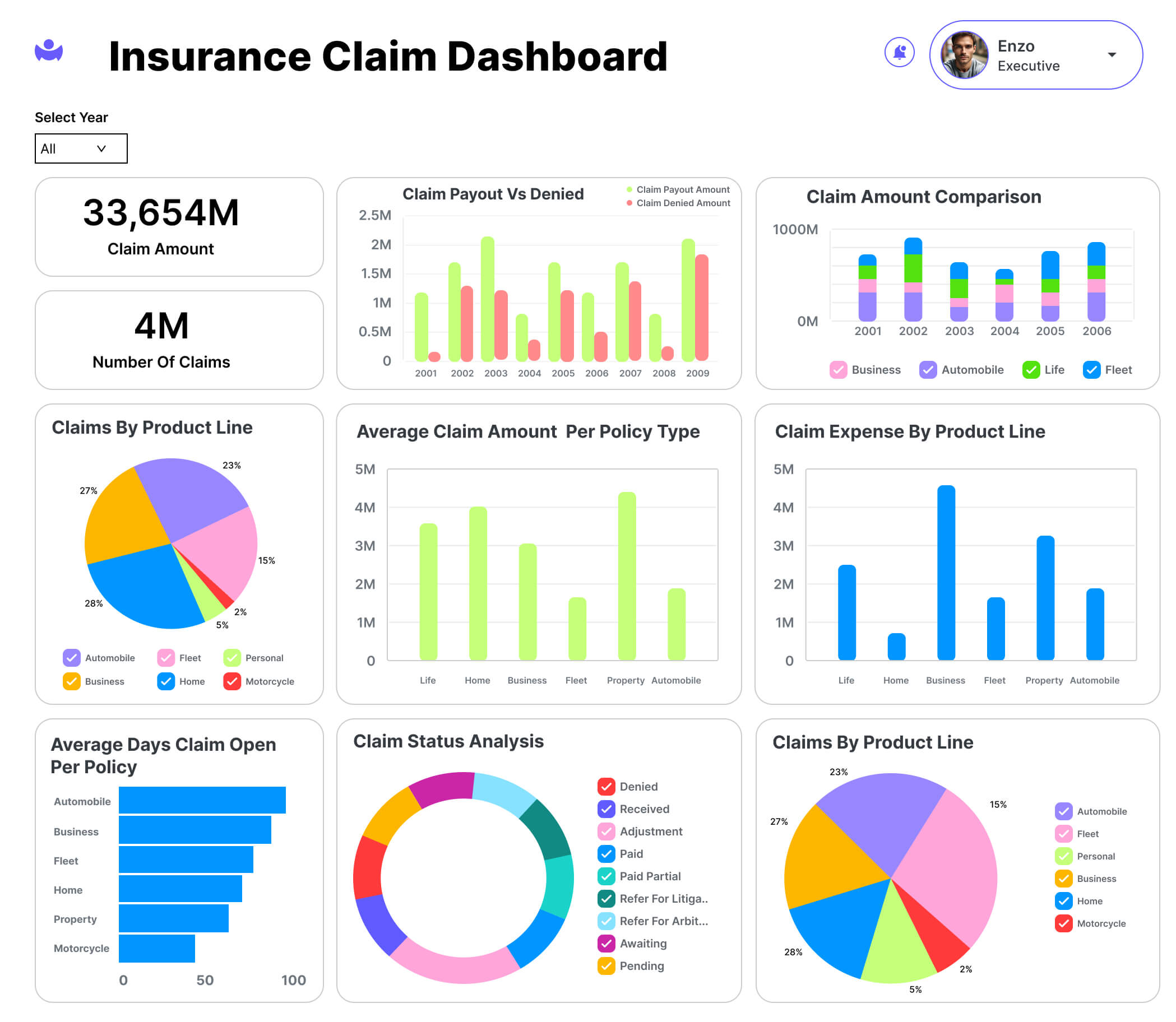

Managing claims effectively is crucial for insurance providers. Our intuitive claims dashboards provide real-time analytics so you can make data-driven decisions.

With our dashboards, you can:

With comprehensive insights into your claims handling, you can enhance processes and reduce expenses. Our dashboards transform messy data into clear visualizations.

Contact us now to boost insurance analytics.

With Xylity as your guide, insurers can achieve transformative business outcomes:

By migrating analytics to Azure, insurers benefit from limitless scale, reduced costs, and blazing fast query speeds. One client improved query performance by 3x after moving to Azure Synapse Analytics. With effortless scalability, insurers can ingest surging data volumes.

Comprehensive controls safeguard data access while advanced protections shield against external threats. With row-level security, data encryption, and threat monitoring, insurers gain peace of mind to explore insights without distraction.

Reduced latency and real-time dashboards accelerate insights for agile decision making. With cloud analytics, risk models operationalize to detect fraud during underwriting versus after claims are paid.

With scalable computing power, insurers sharpen pricing models and achieve hyper-personalization. Advanced ML algorithms crunch alternative data to customize policies based on each customer’s risk profile.

By elevating analytics to the cloud, insurers drive transformative outcomes. Let Xylity help you unlock the full potential of your data. The sky’s the limit!

The journey doesn’t end upon cloud migration. With your insurance analytics now soaring, Xylity provides ongoing management for smooth cruising.

Continuously monitor performance KPIs and fine-tune to maximize speed, agility, and cost-efficiency. Like a self-driving car, analytics autopilots using insights to self-adjust.

Easily spin up extra capacity to handle spikes in data volume. Cloud’s flexible consumption model lets you scale seamlessly without limit.

Focus Agile development on max business impact. Quickly illuminate new capabilities like AI-infused predictive models.

The Journey Begins with an Honest Conversation

Let us assess your needs and chart your flight plan to cloud success.

With Xylity as your copilot, insurers can reach new heights through cloud analytics. But first, we need to understand your challenges and goals. Reach out today to schedule a consultation. Together, we’ll map your flight plan to unlock the power of your data in the cloud!

24610 Durindal Ter,

Sterling, VA 20166, USA.

3rd Floor, 340 F-AD

Scheme 74-C, Vijay Nagar, Indore – 452010, M.P

Bronowicka 17A,

Krakow 30-084

Bleicheroder Straße 13, 13187,

Berlin, Germany